Program Curriculum

B.Fin-Program Specification 2018

CREDIT TRAINING PROGRAM FOR COHORT 2018-2022

MAJOR: FINANCE - BANKING

1 GENERAL INTRODUCTION

1.1 Programme educational objectives (PEOs)

Aim to provide students with a foundation of general, basic and specialized knowledge in finance and banking with scientific research ability and professional practice skills, the Finance - Banking program has 2 educational objectives. Specific Education (PEO):

- PEO1: training bachelors in Finance - Banking with political and ethical qualities, mastering basic knowledge and professional practice skills in corporate finance, banking and accounting in the sector economy. Students majoring in Finance - Banking are trained according to the program of the Ministry of Education and Training, combined with training based on criteria suitable to the needs of society and localities... and have references from the program. Programs of advanced countries, domestic and foreign universities, etc. help students to have research capacity and ability to solve professional problems in the field of corporate finance, banking. Therefore, students studying and graduating with a major in Finance - Banking can work in many different fields.

- PEO2: Trained human resources capable of learning to improve qualifications, capable of scientific research with high application and creativity; have political and moral qualities; have good health, have professional responsibility, have a sense of serving the people; have basic and in-depth knowledge in the field of finance and banking; Logical thinking, capable of updating knowledge; Ability to work independently and in team coordination; Ability to detect and solve problems in the field of Finance and Banking. These human resources gradually train themselves to become managers to meet the needs of organizations.

1.2 Position and ability to work after graduation

Graduates of the Bachelor of Finance - Banking can work in positions such as:

- Financial management specialist at commercial banks, financial companies, insurance companies, securities companies, investment funds, domestic and foreign enterprises; or at state organizations such as Departments, departments, branches at all levels... and have the ability to study, research and carry out activities to develop into managers at different levels.

- Ability to analyze, synthesize and evaluate financial and banking issues, especially financial and banking issues in the international business environment and conditions of international economic integration. economic.

- Create your own business and look for business opportunities for yourself.

- Work in accounting-finance departments, sales departments of enterprises of all economic sectors.

- Can study and research at the domestic and foreign master's and doctoral levels in Finance-Banking or training majors in the economic field such as: Business Administration, Accounting, Trade, etc. to meet the needs of professional development.

- Can become a research and teaching officer on Finance - Banking at research and training institutions.

- In addition, Finance - Banking graduates can pursue postgraduate studies to obtain master's and doctoral degrees.

1.3 Perspectives on building training programs

Based on the actual needs of the human resource market in the field of Finance and Banking; consult with businesses that have been and are using employees with bachelor's degrees in Finance - Banking; comments from alumni and experts who are lecturers with many years of experience, from which the Faculty of Finance - Accounting develops a training program oriented: Graduates work effectively, each self-training to become a manager to meet the needs of organizations in society; apply current and new technologies in the field of Finance and Banking.

1.4 Form and duration of training

• Form of training: centralized formality.

• Training period: 4 years.

2. EXPECTED LEARNING OUTCOMES (ELOs)

Graduates of the engineering/bachelor's degree program in Finance - Banking must meet the following output standards:

- ELO1: Present basic knowledge about philosophy, law, politics, society in general and economic activities in particular; the basic principles of Marxism-Leninism; Revolutionary line of the Communist Party of Vietnam; Ho Chi Minh Thought;

- ELO2: Apply basic knowledge about basic application fields such as: C math, probability - statistics, linear programming.

- ELO3: Can use English (foreign language) in study, research and work. Apply knowledge and basic skills in information technology such as operating systems, hardware and software..., proficiently use office software such as Microsoft Word, Excel, Power Point, exploit and use Internet, Email.

- ELO4: Can explain issues of economics, economic law, monetary and financial, international economics, international finance, auditing.

- ELO5: Apply knowledge of tax, marketing, corporate governance, international payment, corporate accounting, research methods, statistics, econometrics, setting up and appraising investment projects , insurance, finance and banking operations, accounting and banking.

- ELO6: Analyze stock market fluctuations, corporate finance and activities in the financial and banking sectors.

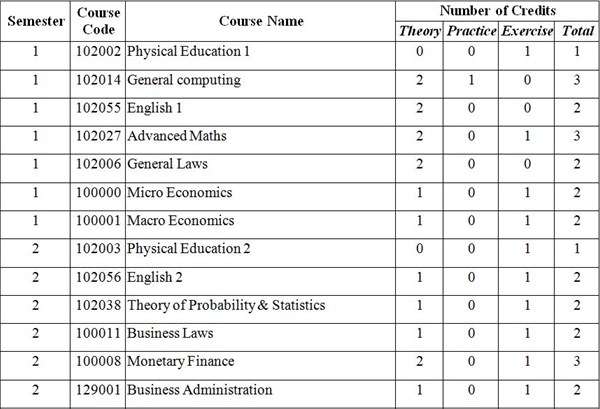

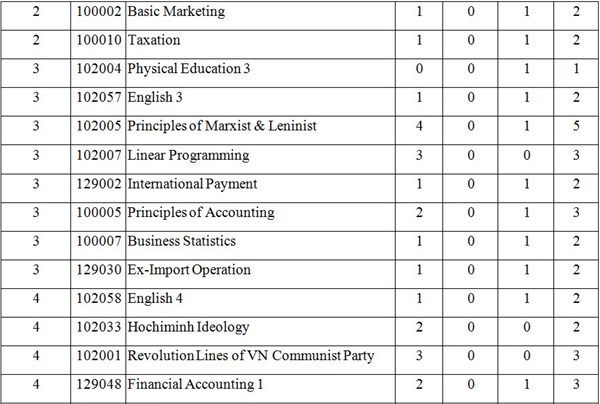

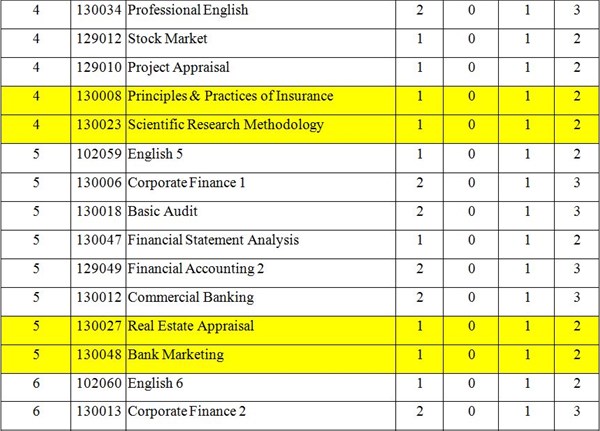

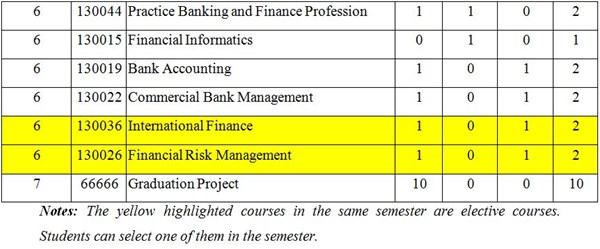

Curriculum: